Los 10 Mejores Casinos Online de Chile en 2024

Guía de Casino Online Chile 💯 – Los Mejores Casinos y Bonos para Jugadores Chilenos

Si quieres jugar en un casino online en Chile, esta guía tiene todo lo que necesitas. Hemos probado sitios de casino que aceptan chilenos para traerte los mejores casinos online de Chile 🇨🇱 para 2024.

| # | Casino | Valoración | Bono de bienvenida | Licencia | |

|---|---|---|---|---|---|

| 1 |

|

Leo Vegas |

1,000,000$ CLP + 120 Giros Gratis

|

Acepta jugadores de Chile |

Regístrate |

| 2 |

|

Spin Casino |

Acepta jugadores de Chile |

Regístrate | |

| 3 |

|

PlayUZU |

80 Giros Gratis Términos y Condiciones |

Acepta jugadores de Chile |

Regístrate |

| 4 |

|

Vulkan Vegas |

700,000$ CLP + 125 Giros gratis

|

Acepta jugadores de Chile |

Regístrate |

| 5 |

|

Ultra Casino |

Acepta jugadores de Chile |

Regístrate | |

| 6 |

|

PlayZee |

1,500,000$ CLP + 150 Giros gratis

|

Acepta jugadores de Chile |

Regístrate |

| 7 |

|

JVSpin |

1,402,000$ CLP + 150 Giros Gratis Términos y Condiciones |

Acepta jugadores de Chile |

Regístrate |

| 8 |

|

Turbico |

300,000$ CLP + 300 Giros Gratis Términos y Condiciones |

Acepta jugadores de Chile |

Regístrate |

| 8 |

|

Rabona |

100% hasta 425,000$ CLP + 200 Giros Gratis + 1 Bonus Crab Términos y Condiciones |

Acepta jugadores de Chile |

Regístrate |

| 10 |

|

PowBet |

100% hasta 430,000$ CLP + 200 Giros Gratis Términos y Condiciones |

Acepta jugadores de Chile |

Regístrate |

| 11 |

|

FEZbet |

100% hasta 425,000$ CLP + 200 Giros Gratis + 1 Bonus Crab Términos y Condiciones |

Acepta jugadores de Chile |

Regístrate |

| 12 |

|

Ice Casino |

100% hasta 1,050,000$ CLP + 270 Giros Gratis Términos y Condiciones |

Acepta jugadores de Chile |

Regístrate |

| 13 |

|

Verde Casino |

100% hasta 850,000$ CLP + 220 Giros Gratis Términos y Condiciones |

Acepta jugadores de Chile |

Regístrate |

| 14 |

|

Betsson Casino |

100% hasta 100,000$ CLP + 50 Giros Gratis Términos y Condiciones |

Acepta jugadores de Chile |

Regístrate |

| 15 |

|

Mr Bet Casino |

400% hasta 1,200,000$ CLP Términos y Condiciones |

Acepta jugadores de Chile |

Regístrate |

| 16 |

|

iBet Casino |

100% hasta 150,000$ CLP Términos y Condiciones |

Acepta jugadores de Chile |

Regístrate |

| 17 |

|

Pin-Up Casino |

$300,000 CLP + 250 Giros Gratis Términos y Condiciones |

Acepta jugadores de Chile |

Regístrate |

| 18 |

|

1xBet Casino |

$1,400,000 CLP + 150 Giros Gratis Términos y Condiciones |

Acepta jugadores de Chile |

Regístrate |

| 19 |

|

BetWay Casino |

$1,000,000 CLP Términos y Condiciones |

Acepta jugadores de Chile |

Regístrate |

Cuando juegas a juegos de casino online con dinero real, es vital elegir entre casinos online internacionales seguros. Llevamos a cabo exhaustivas comprobaciones de seguridad para asegurarnos de que sólo incluimos casinos con licencia y juegos y pagos verificados. Por lo tanto, todos los sitios que aparecen en esta guía de casinos en línea de Chile son seguros para jugar.

Los mejores VIP casinos en línea de Chile 🇨🇱

El mundo de las apuestas en línea se ha vuelto cada vez más popular en Chile, con más y más jugadores buscando los mejores casinos en línea para jugar. En VipCasinos.cl, le facilitamos la búsqueda de su casino en línea perfecto. Nuestro equipo de expertos ha elaborado una completa lista de los casinos mejor valorados por los jugadores chilenos, para que pueda elegir el que mejor se adapte a sus necesidades y preferencias.

Comprobamos cada sitio a fondo antes de recomendarlo aquí, buscando aspectos importantes como medidas de seguridad y protección, opciones fiables de atención al cliente, una amplia selección de juegos de calidad de proveedores líderes como NetEnt y Microgaming, métodos bancarios que acepten depósitos en pesos chilenos (CLP), bonos y promociones lucrativos, pagos rápidos y mucho más.

Los mejores sitios de casino en línea en Chile clasificados para 2024

Muchos casinos en línea aceptan jugadores de Chile. Sin embargo, algunos son mucho mejores que otros. Para encontrar los mejores sitios de casino online para chilenos, utilizamos una serie de criterios para revisar y comparar operadores. La seguridad no es negociable. Comprobamos las licencias y la seguridad para asegurarnos de que sólo los sitios que son seguros para los jugadores chilenos figuran en nuestra lista.

Otros factores clave que utilizamos para calificar los casinos en línea son la selección de juegos, las ofertas de bonos, el rendimiento móvil y las opciones de pago. Al revisar los sitios de casino utilizando estos importantes criterios, hemos clasificado y ordenado los mejores casinos en línea. ¿Quiere saber qué sitios han obteido la mejor puntuación?

Lista de los mejores casinos en línea que aceptan jugadores de Chile en 2024

¿Quieres encontrar casinos online seguros que acepten jugadores de Chile? VipCasinos.cl te guiará hacia el mejor sitio web de casino amigable con Chile para ti.

- 🦁 Leo Vegas

- ⭐ SpinCasino

- 🌀 PlayUZU

- 🥇 FezBet

- 🆕 PowBet

- 🌋 VulkanVegas

- 🚀 PlayZee

- 💛 UltraCasino

- ✨ JVSpin

- 🤝 Turbico

- 🤝 Rabona

- 🧊 Ice Casino

- 🍀 Verde Casino

- 🔥 Betsson

- 🎰 MrBet Casino

- ⚽️ iBet Casino

- 🍒 Pin-Up Casino

- 🥇 1xBet Casino

- 🎲 BetWay Casino

- 🌟 MostBet Casino

- 👑 GGbet Casino

- 🌃 Jackpot City Casino

- ⚱️ Mummy’s Gold Casino

- 💎 Ruby Fortune Casino

- 🏅 MiCasino Chile

- 🎱 888 Casino

- 💥 Spin Palace Casino

- 🌠 Rojabet Casino

- 👑 Royal Vegas Casino

- 🌶️ WinChile Casino

- 🎌 Betsala Casino

- 🌴 Lucky Nugget Casino

Nuestra lista de los 10 mejores casinos en línea de Chile incluye operadores internacionales de buena reputación. Cada sitio tiene licencia de autoridades reguladoras de confianza, incluyendo la MGA y la UKGC. Nuestros sitios recomendados utilizan encriptación SSL para salvaguardar sus pagos y proteger sus datos personales. Ofrecen una amplia selección de juegos, cuya imparcialidad ha sido auditada y verificada de forma independiente.

Todos nuestros casinos online en Chile ofrecen generosos bonos a los jugadores chilenos, con condiciones transparentes. Además, todos los sitios son totalmente compatibles con dispositivos móviles, con fantásticos juegos a los que puede jugar sobre la marcha. También ofrecen un servicio de atención al cliente de calidad en inglés y español. En resumen, estos son los mejores sitios de casino que Chile tiene para ofrecer.

Encuentra Los Mejores Casinos Online de Chile 🎰

VipCasinos.cl es su principal fuente para encontrar los mejores casinos en línea de Chile. Revisamos y calificamos los casinos en línea en base a su legalidad, seguridad, bonos, selección de juegos, opciones bancarias y atención al cliente para asegurarnos de que usted obtenga el máximo provecho de su experiencia de juego en línea.

Nuestro equipo de experimentados profesionales del juego online ha revisado cada casino online chileno para asegurarse de que cumplen con nuestros altos estándares de seguridad, fiabilidad e imparcialidad. Tenemos en cuenta los requisitos legales en Chile, así como cualquier restricción adicional en ciertos países antes de recomendar un casino. Con toda esta información, podemos garantizarle que sólo encontrará casinos chilenos seguros y de buena reputación.

Bonos y Promociones 🎁

En VipCasinos.cl también revisamos y calificamos los bonos ofrecidos por cada casino. Entendemos que los jugadores buscan algo más que grandes juegos a la hora de elegir un casino en línea; ¡también quieren recompensas! Nuestras reseñas detalladas de las promociones de cada casino están diseñadas para ayudar a los jugadores a encontrar los mejores bonos y recompensas disponibles en línea. También tenemos ofertas exclusivas de bonos y ofertas que sólo puede obtener a través de VipCasinos.cl.

Selección de Juegos 🎲

La selección de juegos de cada casino también es importante a la hora de encontrar los mejores casinos online de Chile. Nuestro equipo tiene en cuenta tanto la variedad de juegos disponibles como su calidad. Nos aseguramos de que todos los casinos que revisamos ofrezcan una amplia gama de opciones, incluyendo tragaperras, juegos de mesa, video póker, juegos con crupier en vivo y juegos especiales como el keno y el bingo. Y como sólo recomendamos casinos de buena reputación, puede estar seguro de que ofrecen experiencias de juego de alta calidad con una jugabilidad fluida y gráficos realistas.

Opciones bancarias 💳 y servicio de atención al cliente 👋

Por último, VipCasinos.cl examina las opciones bancarias y el servicio de atención al cliente de cada casino que reseñamos. Nos aseguramos de que los jugadores chilenos tengan acceso a métodos bancarios seguros y confiables tanto para depósitos como para retiros. También comprobamos que el equipo de atención al cliente esté bien informado y sea servicial, para que pueda obtener cualquier ayuda o consejo que necesite de forma rápida y sencilla.

En general, VipCasinos.cl proporciona reseñas detalladas de cada casino en línea en Chile para asegurarse de que sabe exactamente lo que está obteniendo antes de registrarse. Con nuestra minuciosa investigación de los requisitos legales, bonos, selección de juegos, opciones bancarias y servicio al cliente, estamos seguros de que podemos proporcionar la mejor información para asegurar que su experiencia de juego en línea sea positiva. Visítenos para descubrir qué casinos chilenos ofrecen la mejor experiencia de juego.

¿Cómo elegir el mejor casino en línea de Chile? ♥️

- 📜 Revisión de Certificación de Casinos. Los mejores operadores de casino online de Chile están certificados y cuentan con licencia, y puedes comprobarlo en los pies de página de sus sitios web.

- 🎰 Revisión de Juegos de Casino. Explore las categorías de juegos y descubra los proveedores de software que hay detrás de los juegos de casino chilenos. Utilice el motor de búsqueda para encontrar sus títulos favoritos.

- 🪙 Revisión de pagos. Compruebe el porcentaje RTP de su juego de casino CL preferido. Esta es una indicación importante de cuánto puede recuperar de sus apuestas.

- 🎁 Revisión del bono de bienvenida. Consulte los términos y condiciones del bono de bienvenida si juega por primera vez. Tenga en cuenta detalles importantes, como los requisitos de apuesta.

- 💳 Revisión de los métodos de pago. Vaya al cajero del casino y compruebe si se acepta su método de pago preferido para depositar y retirar dinero. Consulte también los límites de depósito.

Todos los juegos con dinero real a los que puede jugar en línea

Los casinos terrestres con licencia de Chile están autorizados a ofrecer cinco tipos de juegos. Estos son la ruleta, los juegos de cartas, los juegos de dados, el bingo y las máquinas tragaperras. Cuando juegue en los mejores sitios de casino en línea que aceptan jugadores chilenos, encontrará todos estos tipos de juegos, y algunos más.

Las tragaperras online son, con diferencia, los tipos de juegos de casino online más populares, y encontrará cientos de los mejores títulos entre los que elegir en nuestros sitios de casino recomendados. También puede jugar a una variada selección de juegos de mesa, como la ruleta, el blackjack y el póquer. Sea cual sea su preferencia, hay muchas opciones de juego disponibles en línea. Aquí tiene una lista de los juegos de casino a los que puede jugar en línea en Chile:

- 🎰 Tragaperras (buenas para jugar con bonificaciones y grandes botes).

- ♦️ Ruleta (El mejor juego de mesa clásico de casino para jugar en línea en Chile)

- ♠️ Blackjack (el mejor juego de casino en línea con altas tasas de pago)

- ♥️ Baccarat (Juego Popular para los Grandes Apostadores Chilenos)

- 🃏 Póker (Mejor Juego para Combinar Estrategia con Habilidad)

- 🇰 Keno (popular juego de casino en línea tipo lotería)

- 🧨 Sic Bo (el mejor juego de dados con muchas opciones de apuesta)

- 🔴 Juegos con crupier en vivo (la mejor experiencia de juego de casino en línea)

- 🎡 Game Shows (emocionantes juegos con reglas sencillas y jugabilidad rápida)

- 🎱 Bingo (el mejor juego de azar para principiantes)

- 🎲 Dados (popular juego de dados con varios tipos de apuestas)

- 🎫 Rasca y Gana (Los mejores juegos de premios instantáneos en Chile)

Casino en Vivo 🔴 – Juegue con crupieres reales en línea

Si desea disfrutar de la experiencia de juego más auténtica en un casino real en línea, los juegos con crupieres en vivo son la mejor opción. Puede jugar a los juegos de mesa más populares y a espectáculos de juegos con crupieres reales en línea. Dado que puedes interactuar con el crupier y con otros jugadores, los juegos de casino en vivo hacen que el juego sea aún más envolvente y entretenido.

Los juegos en vivo son tan populares que todos los principales casinos en línea de Chile cuentan con una plataforma de Casino en Vivo. Todos nuestros casinos online chilenos recomendados ofrecen juegos con crupier en vivo. Con una rica selección de mesas de ruleta, juegos de cartas y ruedas de dinero entre la selección de juegos con crupier real, hay algo que se adapta a todas las preferencias. Los juegos en vivo ofrecen los límites de mesa más altos de los casinos online, lo que los convierte en una opción popular entre los grandes apostadores chilenos. Echa un vistazo a los mejores casinos online de Chile para conocer su selección de juegos en vivo.

Las mejores aplicaciones de dinero real

El juego móvil es muy popular en Chile. Como tal, la mayoría de los casinos online en Chile ofrecen a los jugadores la posibilidad de jugar sobre la marcha. Dado que muchos chilenos prefieren jugar a los juegos de casino en un teléfono móvil o tableta, hemos hecho pruebas exhaustivas para encontrar las mejores aplicaciones de casino móvil en Chile.

Los mejores sitios de casino en línea de Chile son totalmente sensibles a los dispositivos móviles. Los sitios web de los casinos están optimizados para jugar con la pantalla táctil directamente en el navegador. Algunos operadores también han desarrollado aplicaciones nativas para iOS y Android, que puedes descargar en tu dispositivo. Utilizamos una serie de criterios para probar las aplicaciones de casino. Buscamos:

- 1️⃣ Compatibilidad con Android e iOS

- 2️⃣ Selección diversa de juegos aptos para móviles

- 3️⃣ Software seguro

- 4️⃣ Plataforma intuitiva y fiable

Basándonos en esos criterios, aquí está nuestro casino móvil más recomendado en Chile:

| # |

Casino | Valoración | Bono de bienvenida | Bono sin depósito | Licencia | |

|---|---|---|---|---|---|---|

| #1 |  |

Leo Vegas Casino |

1,000,000$ CLP + 120 Giros gratis

|

Regístrate | ||

| #2 |  |

Spin Casino |

600,000$ CLP

|

Regístrate | ||

| #3 |  |

PlayUZU Casino |

80 Giros Gratis Términos y Condiciones |

Regístrate | ||

| #4 |  |

VulkanVegas Casino |

700,000$ CLP + 125 Giros gratis

|

Regístrate | ||

| #5 |  |

PowBet Casino |

100% hasta 430,000$ CLP + 200 Giros Gratis Términos y Condiciones |

Regístrate | ||

| #6 |  |

Fezbet Casino |

100% hasta 425,000$ CLP + 200 Giros Gratis + 1 Bonus Crab Términos y Condiciones |

Regístrate | ||

| #7 |  |

PlayZee Casino |

1,500,000$ CLP + 150 Giros gratis

|

Regístrate | ||

| #8 |  |

UltraCasino |

100% hasta 100,000$ CLP + 100 Giros Gratis

|

Regístrate | ||

| #9 |  |

JVSpin Casino |

1,402,000$ CLP + 150 Giros Gratis Términos y Condiciones |

Regístrate | ||

| #10 |  |

Turbico Casino |

300,000$ CLP + 300 Giros Gratis Términos y Condiciones |

Regístrate | ||

| #11 |  |

Rabona Casino |

100% hasta 425,000$ CLP + 200 Giros Gratis + 1 Bonus Crab Términos y Condiciones |

Regístrate | ||

| #12 |  |

Ice Casino |

100% hasta 1,050,000$ CLP + 270 Giros Gratis Términos y Condiciones |

Regístrate | ||

| #13 |  |

Verde Casino |

100% hasta 850,000$ CLP + 220 Giros Gratis Términos y Condiciones |

Regístrate | ||

| #14 |  |

Betsson Casino |

100% hasta 100,000$ CLP + 50 Giros Gratis Términos y Condiciones |

Regístrate | ||

| #15 |  |

Mr. Bet Casino |

400% hasta 1,200,000$ CLP Términos y Condiciones |

Regístrate | ||

| #16 |  |

iBet Casino |

100% hasta 150,000$ CLP Términos y Condiciones |

Regístrate | ||

| #17 |  |

Pin-Up Casino |

$300,000 CLP + 250 Giros Gratis Términos y Condiciones |

Regístrate | ||

| #18 |  |

1xBet Casino |

$1,400,000 CLP + 150 Giros Gratis Términos y Condiciones |

Regístrate |

Los mejores casinos online de Chile mantienen al mínimo las diferencias entre sus plataformas de escritorio y móvil. Ofrecen una amplia variedad de juegos que han sido expertamente optimizados para jugar sobre la marcha. Aun así, debes tener en cuenta que algunos títulos de juegos más antiguos y menos populares pueden no estar disponibles para jugar en una aplicación.

Dado que el juego sobre la marcha es tan popular, los mejores desarrolladores de software de casino crean juegos con el juego multiplataforma a la vanguardia del diseño. Así, en la mayoría de los casos, podrá jugar a sus juegos de casino favoritos en su iPhone, iPad o dispositivo Android. Además, podrá disfrutar de los últimos lanzamientos de juegos cómodamente en su móvil.

Nuevos mejores casinos [Elección del Editor] 2024

Nuevos mejores casinos [Elección del Editor] 2024

Los mejores bonos de casino en línea para chilenos

Los casinos en línea le ofrecen un acceso rápido y cómodo a los juegos de casino con dinero real. Sin embargo, otra ventaja de jugar en línea son los bonos de casino. Para animar a los nuevos jugadores a unirse, la mayoría de los casinos en línea de Chile ofrecen un bono de bienvenida. Estas ofertas son muy valiosas para los jugadores, ya que aumentan su bankroll y le permiten jugar más tiempo.

La mayoría de los bonos de bienvenida se conceden al realizar el primer depósito. Su dinero será igualado, y también puede ser recompensado con giros gratis. También puede aprovechar las ofertas de paquetes de bonos de bienvenida, que le ofrecen bonos por varios depósitos. Si quiere aprovechar las mejores ofertas, aquí tiene los mejores bonos de casino en línea para chilenos que están disponibles actualmente:

Mejores Bonos de Casinos en Chile

Antes de reclamar un bono en un casino online en Chile, siempre debe leer los términos y condiciones promocionales. Allí encontrará los requisitos de apuesta. La mayoría de los bonos de casino deben jugarse para convertir las ganancias del bono en dinero real. Por lo tanto, las ofertas con requisitos de apuesta bajos son las más convenientes para jugar.

Además, tenga en cuenta a qué juegos le gustaría jugar cuando elija una bonificación. Algunos juegos pueden estar excluidos de las apuestas de los bonos, mientras que otros sólo pueden contribuir con una pequeña fracción. Fíjese también en las restricciones de tiempo. Elija bonos que le den tiempo suficiente para completar las apuestas antes de que caduquen.

Los mejores métodos de pago para los jugadores chilenos 💰

Para reclamar un jugoso bono de bienvenida y jugar online con dinero real, primero tendrá que hacer un depósito. Por esta razón, los métodos de pago aceptados son una consideración importante a la hora de elegir en qué casinos online de Chile jugar. Los mejores sitios de casino en línea para jugadores chilenos admiten una amplia gama de métodos de pago seguros y convenientes. Algunos incluso aceptan pagos en pesos chilenos. Aunque, en la mayoría de los casos, utilizará una divisa con mayor respaldo, como los dólares estadounidenses.

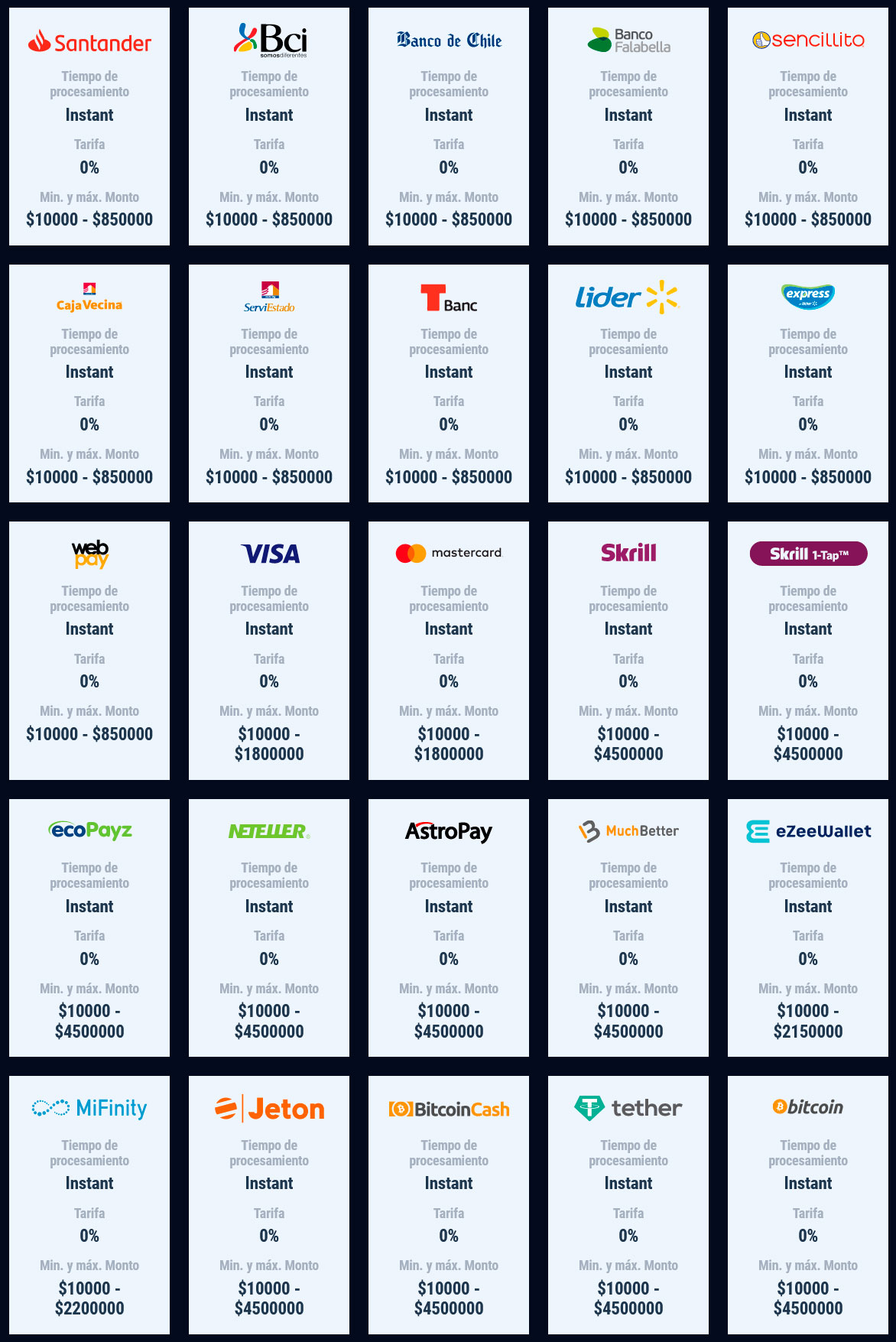

En todos los casinos online de renombre se aceptan las principales tarjetas de crédito y débito. Sin embargo, los mejores casinos en línea de Chile también ofrecen muchas alternativas. Entre ellas se incluyen monederos electrónicos, tarjetas de prepago e incluso criptomonedas como Bitcoin. A continuación, puede ver de un vistazo, los muchos tipos de métodos de pago que se admiten en los casinos en línea de Chile.

Los jugadores de Chile suelen buscar un casino en línea con PayPal. El monedero electrónico es la mejor opción para hacer depósitos en casinos online, gracias a su avanzada seguridad y protección de la privacidad. Muchos de nuestros casinos en línea recomendados para jugadores chilenos aceptan PayPal. Sin embargo, no admiten pagos con PayPal para jugadores de Chile.

Existen monederos electrónicos alternativos que ofrecen ventajas similares a PayPal. Nuestra principal recomendación es Neteller. Este método de pago de confianza le permite realizar depósitos en un sitio de casino sin compartir sus datos bancarios. Esto añade seguridad adicional a sus pagos, así como un mayor anonimato. Depositar con Neteller es rápido y sencillo, y las retiradas se procesan con rapidez.

Visión general de los juegos de azar en Chile 🌐

Los chilenos pueden disfrutar de varios tipos de juegos de azar legalmente en el país. Existe un monopolio estatal sobre la lotería y las apuestas deportivas, siendo Pollo Chilena el único operador con licencia para ofrecer este tipo de juegos de azar en Chile. Las leyes del juego promulgadas en 2005 permitieron el funcionamiento legal de los casinos terrestres. La industria del juego de casino en Chile está supervisada por la Superintendencia de Casinos de Juego (SCJ).

Los casinos del país son una importante fuente de financiación socioeconómica. Sin embargo, las leyes prohíben explícitamente el juego de casino en línea en Chile. Sin embargo, la SCJ y los principales representantes del sector han presionado para que se establezca un marco regulador y de concesión de licencias que permita a los casinos en línea operar legalmente en el país.

Juegos de azar en línea en Chile 🇨🇱

El juego es un pasatiempo muy extendido en Chile. Como a la mayoría de la población mundial, a los chilenos les gustan los juegos de casino, las apuestas deportivas, el póquer, la lotería y el keno, entre otros. Lo que hace aún más sorprendente que el casino en línea no esté regulado en el país. Esto no quiere decir que el juego sea ilegal en esta parte del mundo. De hecho, la gente en Chile tiene acceso a docenas de casinos offline de ladrillo y mortero que son totalmente legales, además de otras actividades de juego populares en el mundo real. El problema en Chile es que los juegos de azar en línea no están regulados, lo que abre la puerta a que prosperen los operadores de estafas y los defraudadores. Los mercados de juego regulados aplican controles para reducir el impacto de los operadores deshonestos. Como el juego de casino en línea en Chile no está regulado, los jugadores de casino deben ser especialmente cautelosos cuando juegan en línea.

La falta de regulación en este ámbito significa que no existen casinos online chilenos legales y con licencia. Sin embargo, no hay regulaciones estrictamente aplicadas que digan que la gente dentro de Chile no puede disfrutar de los juegos de casino online. Los jugadores siguen teniendo acceso a casinos online internacionales que operan fuera de las fronteras del país. Muchos operadores extranjeros están encantados de aceptar jugadores de esta parte del mundo. Si reside en Chile y busca un casino en línea fiable, tiene muchas opciones a su disposición.

Casinos en línea de confianza en Chile 🛡️

Los casinos son un gran negocio y, como tal, deben mantener altos estándares para seguir siendo rentables. Esto significa ofrecer excelentes bonos y promociones, así como un servicio de primera categoría. Los casinos en línea de confianza que gastan millones en marketing hacen todo lo posible para proteger su reputación. Esta es una buena noticia para los jugadores que desean jugar a juegos de casino en línea en mercados no regulados, como Chile.

Nuevos Casinos Online en Chile 🆕

Puede que los nuevos casinos online no inspiren la confianza que las marcas establecidas, pero ofrecen un buen número de ventajas. Los nuevos casinos online chilenos tienen que trabajar más duro que el resto para establecerse en el mercado. Para los jugadores de casinos en línea chilenos esto significa opciones de juegos diferentes y novedosas y bonos de casino más altos. Los nuevos casinos online no cuentan con los presupuestos de marketing de los que disfrutan los locales online ya establecidos. Para atraer a nuevos clientes, deben liderar con bonos llamativos para atraer a nuevos jugadores. También suelen ser mucho más innovadores. Esto significa que los jugadores pueden esperar una gama más diversa de juegos que no suelen estar disponibles en los grandes casinos y funciones de casino nuevas y exclusivas. Investigamos cada nueva plataforma y operador antes de que entren en nuestras listas de casinos.

Leyes sobre el juego de casino en Chile ⚖️

La Ley del Juego número 19.995 de 2005 legalizó los casinos terrestres en todo Chile. En virtud de esta ley, se creó la Superintendencia de Casinos de Juego (SCJ) para regular el sector. El artículo 5 de las leyes sobre casinos de juego establece que los juegos de casino en línea no están permitidos. La SCJ envió recientemente una carta oficial a todos los operadores de casinos del país, reiterando que no está autorizado ofrecer juegos de azar en línea.

Si bien es ilegal operar un casino en línea en Chile, la ley no prohíbe a los chilenos jugar en sitios de casinos ubicados fuera del país. Por esta razón, varios de los principales operadores internacionales de casinos en línea han abierto sus puertas a los jugadores chilenos. Los chilenos pueden jugar en un sitio de casino offshore sin temor a repercusiones legales.

Sin embargo, dada la falta de regulación y protección local, los jugadores deben tener cuidado al elegir un sitio para jugar. Los jugadores deben optar por sitios de casino autorizados por jurisdicciones de juego de confianza, como Malta, Gibraltar o el Reino Unido. Los casinos en línea autorizados ofrecen juegos justos que han sido verificados de forma independiente. También emplean sofisticados protocolos técnicos de seguridad para proteger sus datos confidenciales. Los sitios legales también realizan comprobaciones de identidad para asegurarse de que sólo los jugadores mayores de 18 años pueden acceder a sus juegos con dinero real.

Juego responsable en Chile 🚩

Parte del cometido del SCJ es encontrar el equilibrio adecuado entre los beneficios socioeconómicos del juego y la responsabilidad social. El SCJ ofrece diversos recursos a los jugadores que puedan verse afectados por problemas de juego. Entre ellos se incluyen pruebas de autoevaluación y recomendaciones de ayuda. Aunque no hay casinos en línea en Chile que estén regulados por la autoridad chilena, los sitios de casino con licencia offshore de buena reputación están igualmente comprometidos con el juego responsable.

Cuando juegue en los mejores sitios de casino en línea que aceptan jugadores de Chile, se le proporcionarán diversas herramientas para ayudarle a gestionar su conducta de juego. Entre ellas se incluyen opciones para establecer límites de depósito, tomarse un descanso o autoexcluirse por completo. Los casinos de confianza también colaboran con organizaciones especializadas en la investigación, educación y tratamiento de la adicción al juego. Los casinos en línea legítimos incluirán los datos de contacto de organizaciones como Jugadores Anónimos y Terapia del Juego, que pueden ofrecer apoyo profesional a cualquier persona afectada por la adicción al juego.

Datos Interesantes 🙌

👉 Preguntas frecuentes sobre casinos en línea en Chile

Hemos llevado a cabo una investigación exhaustiva para crear esta guía sobre casinos online en Chile. Descubrimos que los jugadores suelen plantear las mismas preguntas sobre el tema. Por ello, decidimos recopilar las preguntas más frecuentes en una práctica sección de preguntas frecuentes. Nuestro equipo de editores ha proporcionado respuestas claras y concisas, con todos los detalles que necesitas.

¡Visite VipCasinos.cl ahora para comenzar a jugar en los mejores casinos en línea de Chile! Con nuestras detalladas reseñas y exclusivas ofertas de bonos, puedes estar seguro de encontrar el casino perfecto para tus necesidades de juego. ¡Buena suerte y feliz juego!

Para más consejos y estrategias de juego online, visite nuestro blog hoy mismo. Proporcionamos información actualizada sobre las últimas noticias, tendencias y estrategias en el mundo de las apuestas en línea, para que pueda mantenerse informado y tomar decisiones inteligentes a la hora de jugar. Gracias por visitar VipCasinos.cl – ¡esperamos que se divierta jugando en el casino chileno de su elección!

Conclusión: El mejor casino online de Chile

Hemos llegado al final de nuestra guía de los mejores casinos online de Chile. Así que vamos a recapitular las cosas importantes que necesitas saber. Muchos sitios de casino internacionales de buena reputación aceptan jugadores de Chile. Los mejores sitios tienen licencia y son seguros para jugar.

Aunque en la actualidad los jugadores de Chile no pueden elegir un casino en línea con sede en su país de origen, existen muchas alternativas estupendas. Muchos casinos en línea internacionales tienen licencias creíbles y de confianza del Reino Unido, Malta, Gibraltar y Curazao. Mejor aún, muchas opciones brindan soporte en idioma español y ofrecen pesos chilenos, dólares estadounidenses y billeteras populares que los jugadores chilenos pueden utilizar.

Puede encontrar los mejores casinos en línea comparando la selección de juegos, las ofertas de bonos, las opciones de pago y otros criterios similares. Para ahorrarle el trabajo duro, hemos revisado los operadores para ofrecerle una lista de los 10 mejores casinos en línea de Chile. Consulte la lista para encontrar el mejor casino chileno para usted.

Nuevos mejores casinos [Elección del Editor] 2024

Nuevos mejores casinos [Elección del Editor] 2024

Viví varios años en Europa y ahora estoy de vuelta en Chile, mi tierra natal. Me gusta jugar en casinos los fines de semana, tanto clásicos como online. Jugar juegos de casino en línea desde Chile es ahora una experiencia increíble. Con los rápidos avances de la tecnología de Internet, cada vez son más los casinos que ofrecen fantásticos bonos, promociones e incluso tiradas gratis a los jugadores de Chile. La gama de juegos disponibles también se está ampliando con algo para todos los gustos. Además, es increíblemente cómodo, ya que todo el juego tiene lugar en su ordenador o dispositivo móvil en casa. Todo lo que necesitas es una conexión estable y ¡listo!

Hola, ¿cuáles son los juegos más populares en América Latina?

Los juegos más populares en Latinoamérica son las tragaperras, las máquinas de video póquer, el blackjack, la ruleta, el bingo y las tarjetas de rasca y gana. En algunos países, como Chile, también son especialmente populares las versiones con crupier en vivo de los juegos de mesa clásicos de casino, como el Blackjack y la Ruleta.

Algunas de las tragaperras más populares en Chile son:

Gracias por la información, accesible y comprensible. ¿A qué tipo de juegos puedo jugar en los casinos en línea chilenos?

La mayoría de los casinos en línea chilenos ofrecen una amplia variedad de juegos de casino, como tragaperras, máquinas de video póquer, blackjack, ruleta, bingo, baccarat y mucho más. Las tragaperras más populares también están disponibles, incluidas aquellas con botes progresivos que ofrecen enormes premios en metálico.

También encontrará versiones con crupier en vivo de juegos de mesa de casino clásicos como el Blackjack y la Ruleta. Además, algunos casinos en línea pueden ofrecer mesas VIP exclusivas para grandes apostadores o torneos especiales disponibles sólo para sus clientes registrados.

¿Hay bonificaciones disponibles para los jugadores ya registrados?

Sí. La mayoría de los casinos en línea de Chile ofrecen atractivos bonos a los jugadores actuales. Estos suelen incluir premios de fidelidad, ofertas de devolución de dinero y bonos de recarga. También es posible que te ofrezcan promociones o descuentos exclusivos al jugar con un casino en particular.

💡 Truco de vida: La mayoría de los casinos sólo ofrecen buenos bonos sólo para los nuevos jugadores, pero se puede utilizar un correo electrónico diferente y número de teléfono, así como una VPN para volver a crear una nueva cuenta. Si necesitas ayuda – envíanos un correo electrónico a través del formulario de contacto, y te diremos cómo hacerlo legalmente y sin romper las reglas del casino.

Los casinos online en Chile suelen ofrecer generosos bonos de bienvenida para los nuevos jugadores. Puedes conseguir tiradas gratis en máquinas tragaperras o un gran bono en efectivo cuando hagas tu primer depósito en tu cuenta. Además, muchos jugadores habituales pueden beneficiarse de bonos de recarga que les proporcionan dinero extra cada vez que realizan un depósito en su cuenta. Asegúrese de leer detenidamente los términos y condiciones antes de aceptar cualquier oferta de bonificación.

¿Puedo depositar con criptomonedas? ¿Qué casinos fiables puede recomendarnos? Gracias.

Sí, las criptomonedas como Bitcoin, Ethereum, USDT, etc. son aceptadas por algunos casinos en Chile (como Bitcasino.io, BC.Game, Rabona, Bodog, 20Bet, Bizzo Casino, Wazamba, RioBet), lo que permite a los jugadores aprovechar las bajas comisiones por transacción, y los pagos anónimos. Pronto prepararemos una lista separada de casinos que aceptan criptodivisas.

¡Hola! ¿Son seguros los depósitos y las retiradas? ¿Qué métodos de pago me recomiendan?

Sí, ¡al 100%! Todos los casinos online chilenos de confianza utilizan tecnología de encriptación SSL para mantener sus fondos seguros mientras juega. Muchos sitios también aceptan pagos a través de métodos de pago de confianza como tarjetas de débito Visa/MasterCard o monederos electrónicos como Skrill y Neteller.

Los siguientes tipos de pago también son bastante populares en Latinoamérica: Santander, BCI, Banco de Chile, Banco Falabella, Sencillito, Caja Vecina, Servi Estado, TBanc, Lider, WebPay, Ecopayz, AstroPay, MuchBetter, eZeeWallet, MiFinity, Jeton.

Elija la forma que más le convenga. Puede estar seguro de que sus depósitos y retiradas serán seguros.

¿Cuál es la situación legal de los juegos de azar en Chile? Explíquelo con palabras sencillas, por favor.

❗ 💡 Actualmente, Chile permite el juego en casinos terrestres, pero no existe ningún tipo de regulación respecto al juego online. Es decir, el juego online no está prohibido y las marcas de casinos más populares con licencias internacionales están disponibles para todos los chilenos.

Gracias por la aclaración, durante mucho tiempo no pude encontrar la información exacta. Y la última pregunta: ¿qué opciones de atención al cliente ofrecen los casinos?

No hay problema, adelante 👍

La mayoría de los casinos ofrecen un servicio de atención al cliente 24 horas al día, 7 días a la semana, a través de chat en vivo, correo electrónico o teléfono. Cuando necesite ayuda con cualquier cosa relacionada con su cuenta o tenga preguntas sobre un juego en particular, su amable personal estará encantado de ayudarle. Además, muchos sitios también cuentan con útiles secciones de preguntas frecuentes que ofrecen información detallada sobre temas como los métodos bancarios y los términos y condiciones de los bonos.

Los sitios de casino modernos son muy sencillos, cómodos, automatizados e intuitivos. En general, rara vez es necesario ponerse en contacto con el servicio de asistencia técnica.